How to migrate your old PIN to iTax

KRA has issued a notice to invalidate/deactivate all PIN not registered on the Itax platform. This deactivation will be done on 31st August for those who do not comply.

Why should this be an issue?

- An invalid PIN means you will not be able to purchase land, or a car or bid for some tenders

- Banks and insurance company need a PIN before opening a bank account or issuing an insurance policy.

- KRA will penalize you for not submitting tax returns as this can only be done on the iTax platform.

You can check your KRA PIN status is active. In compliance with the Tax Procedure Act, 2015, KRA made it mandatory for all taxpayers to use the iTax platform for PIN registration, filing of returns, payment and access of other tax-related services.

Follow the below steps to ensure that your pin is updated at iTax.

STEP BY STEP GUIDE

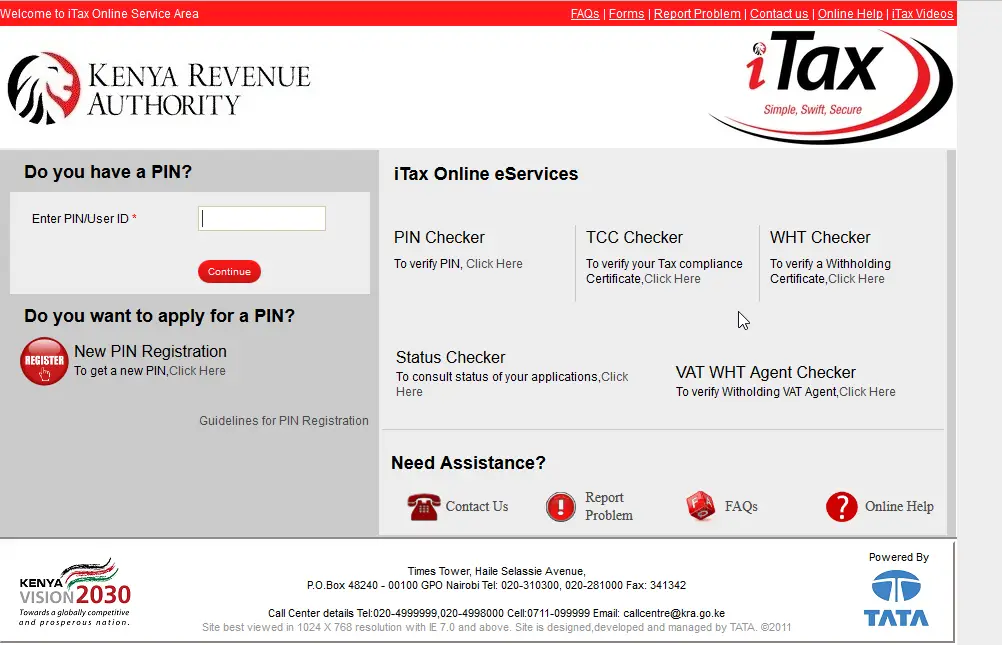

STEP 1. ACCESSING KRA PIN PORTAL

Access the KRA portal and a page similar to this appear. Follow this link to access https://itax.kra.go.ke/KRA-Portal/

Enter your current PIN in the blank space and click to continue.

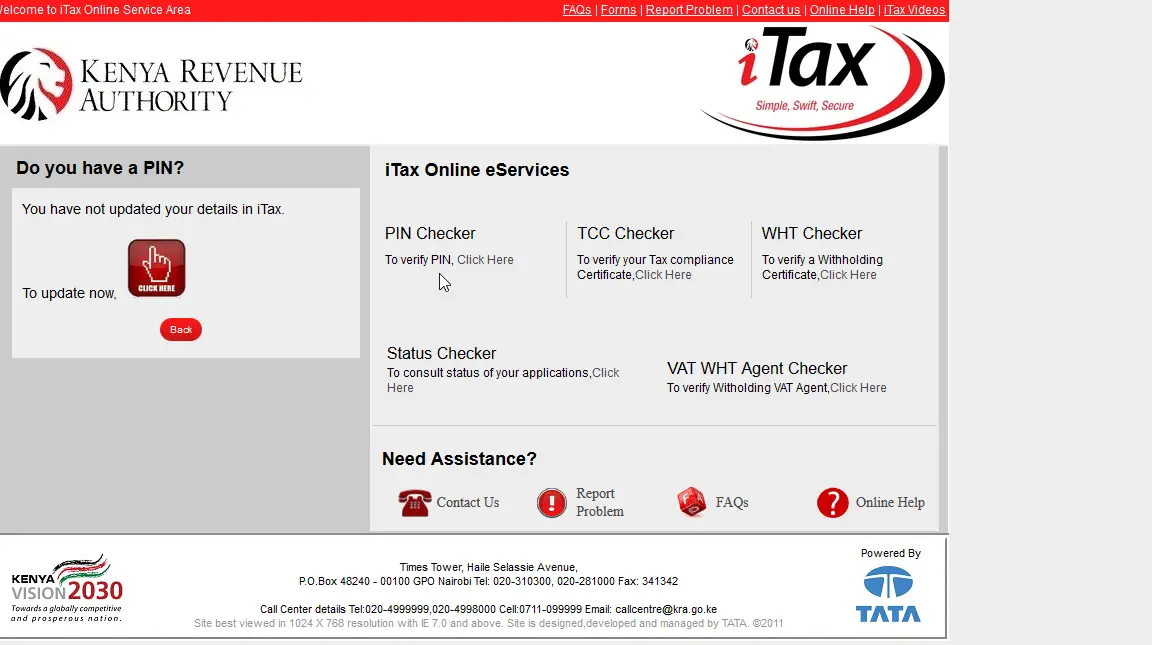

If you are not updated to Itax a page similar to this appears.

Step 2. Updating page

• To continue click to update now.

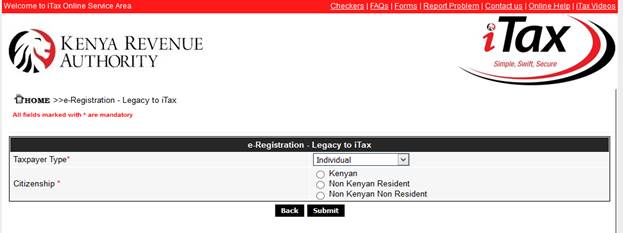

After this the next page appearing will look like this.

Step 3: Taxpayer Type & Citizenship category

On this page select your citizenship category accordingly, and continue.

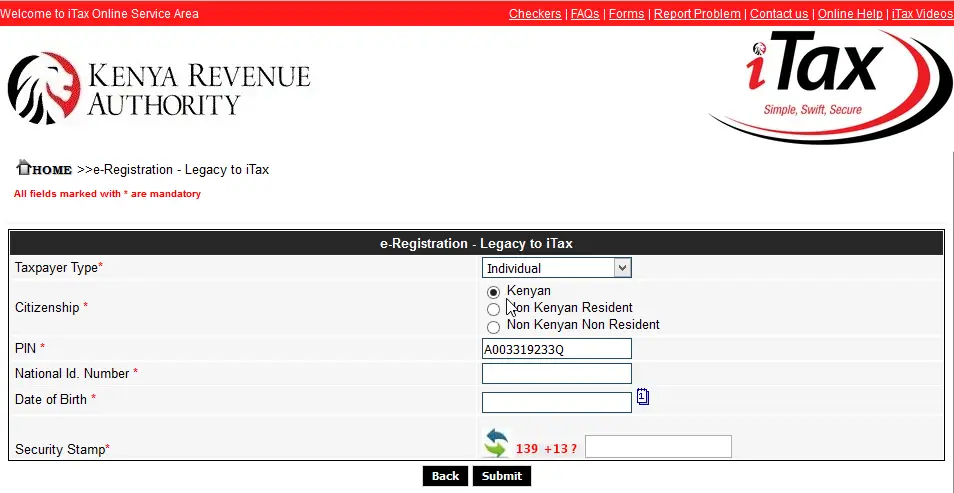

The next page will have this appearance.

Step 4. Personal Details

- Here you are required to input your I.D number and date of birth.

- Lastly input the answer of the simple calculations in the security stamp section .

Step 5 : Updating Basic information.

Don’t despair you are halfway done. The next page will ask you the personal details to create your KRA ledger.

- Provide with all the necessary personal basic information.

• The information provided will be key to updating your ledger.

• The proceeding page is for obligation.

STEP 6: OBLIGATIONS PAGE

- This page cannot be altered so proceed to the next page.

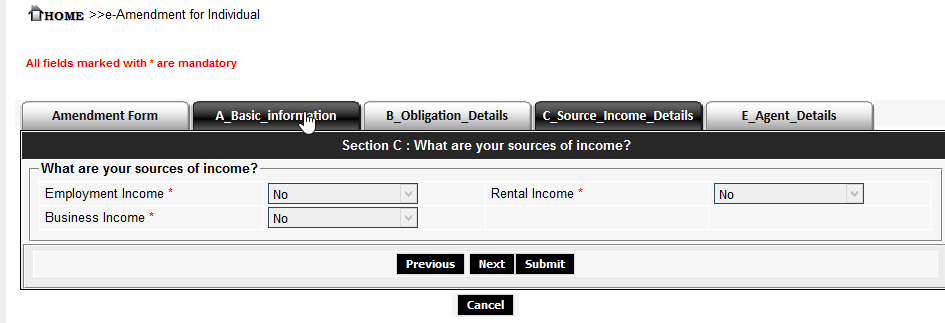

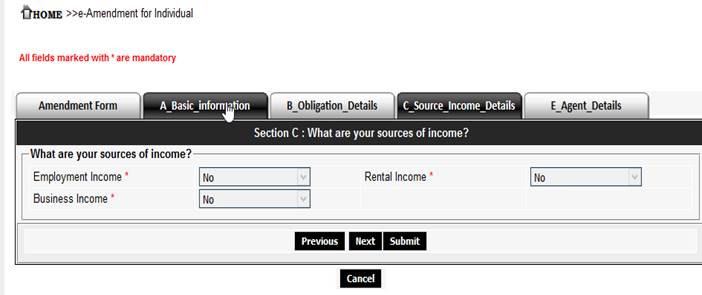

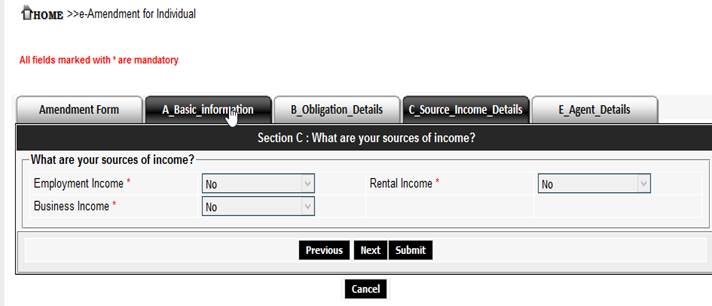

STEP 7: SOURCE OF INCOME

- Select your source of income.

- If employed select employment income and remember to file PAYE each month.

- Running a business then select business income and proceed to add it to your ledger.

- The last option is for those who are land lords.

- Select your option and proceed.

- NB: If you are not employed, running a business or a land lord check all the boxes with NO.

STEP 8: AGENT DETAILS.

- This section do not alter anything by pass to the last section.

STEP 9: SUBMISSION

Last page on KRA PIN update

- This is the last step

- Submit the information and NOW you are updated to Itax.

- A notification for successful update will be received from KRA Via the email you registered

Maureen. Very helpful

Quite helpful; simple and straightforward!