How to check the NHIF account contribution status on your Phone

The NHIF has made it easy for all its clients to check their status on their phones. You simply need to send an SMS with name ID followed by your ID number to 21101.

This makes it easy for members as the alternative was either the hospital or a long walk to NHIF offices.

Related: How to change your NHIF preferred hospital

What you need

- You should have at least 10 shillings credit on your Safaricom line. This is a premium rated service so bundle SMS /Okoa Jahazi will not work.)

- Your National ID number or Passport number

Procedure

Once you are ready with the above

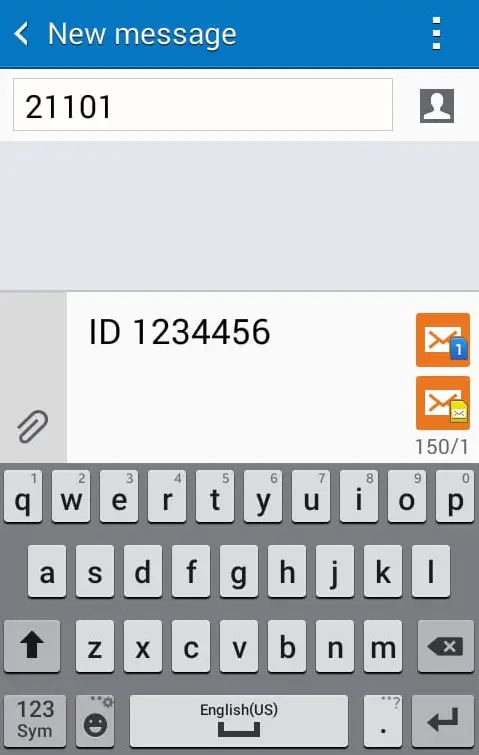

Compose a new SMS starting with the letters ID followed with your ID or passport number

Example: ID 12345678

Send the message to 21101

You will receive a text showing your last payment date and the dependants on your NHIF account.

Answers to frequently asked Questions

What is the waiting period for NHIF or put differently how long does it take to access NHIF services after registration?

As we know NHIF has two types of membership, formal and informal. When you are in the informal sector your waiting period is 60 days while those in the formal sector have 30 days waiting period.

What’s is the waiting period for a dependent on NHIF?

NHIF has made it really easy for members to add their dependents. A dependents “card” becomes active immediately once you finish the registration process.

How long does it take for MPESA payments to be uploaded?

M-PESA payments are known to take between 24 and 48 hours although there are instances when M-PESA payments reflect immediately.

What happens when you break your contribution?

There are two options for this. You can decide to pay the principal amount and then wait for sixty days before you can resume using the service. Alternatively, you can pay the arrears plus penalties and be activated on the spot.

What are the penalties for late payment?

You need to pay your NHIF by the 9th of each new month. If you fail to pay by this date then you or your employer depending on your type of contribution will have to pay extra.

In the case of an employer missing payment they will be required to pay double the principal.

When an individual or as they call them informal contributor fails to pay on time they will need to pay 50% on the principal. That would be 500 plus 250 which will be 750.

RELATED: How to check your NHIF number in case you misplace the card

Visit http://www.nhif.or.ke for more information on NHIF

I regestered for NHIF for my parents, I chose a hospital near home but when it was mature we found out the hospital was different which is very far from home… I wanted to changed to the nearest hospital… What is the procedure???

Hi.i applied the nhif cover and made a payment of 3 months which is 1500 hundred,when i went to check if my card has matured i was told that i paid

in someone else’s member no.9937923.i went to nhif offices with all what is required and they promised to reverse the money to my account,which still when i check,am being told no contribution has been made that am in arrears .kindly assist.

You will need to call NHIF on 0800 720 601 (Toll Free) / (020) 272 3246 / 0726 268 933.

Sometimes people lose jobs or even retire. How does the current regime expect to receive Universal Health Care with punitive policies like late payment penalties for NSSF?

can i get my contribution statement cause on 9/05/19 i received sms that my account is in arrears but according me av been contributing promptly without any delay on or before deadline date of 9th of every month. card no. 587111

i request for my contributions and how exactly my name appears in your system

Hallo… How do I join the Supa cover?

Hi,am winnie.what happens if I default for 3 months?Would I be required to start afresh or would I be forced to pay for then contribution plus the penalties and continue paying?Can someone deactivate the account then start afresh?Please advise.

please its taking too long for me to get NHIF card yet I registered on January and my pregnant wife keeps on paying cash every time she goes for a clinic yet am contributing to NHIF monthly . How can be assisted?….whenever I go for the card am told there is no printers….is it my fault to know the availability of your stationaries??

Kind Regards,

Boniface Vundi.

I recently registered and paid the required 1500.when should I pay next.self employed

Remind me of the outpatient hospitals chosen

Hello,

I have checked my last contribution date and it was successful, thank you

Though i would to ask if its possible to correct my name coz i have noticed a small error which might be a problem in future. my correct names are magdalene mumbua mumo… but according to the sms that i have received its magdaline mumbua mumo. can i get help please

Regads,

Magdalene.

can the Nhif account can be affected before it takes 60 days after registration?

How do I pay my instalments which my employer did not pay while I on an unpaid sick leave for two months?

What should i do in-case am given a prescription to go and buy drugs by my preferred facility

Hi,am Jay how can i be certain of the beneficiaries of my card

hey

after paying the 1500 when registering when should I pay the next

I want to know my last payment

Compose a new TEXT message with the letters ID followed with your ID or passport number

I.e. ID12345678 Send the message to 21101

Stopped paying for my contribution several years back, how do I Start off again ID. 9505342

Sijalipa tangu 2005, nitaanzaa wapi na nina taka kwanza kulipa

Hae,I need to see debt that Milka cheruiyot have, I’d no 3310647

Hi,am paul how can I know my contribution in my nhif acount

Emailed customercare and sent a text thrice charged 10 per text and the reply was system currently unavailable …disssapointed

Martin musyoka want to continoue to pay ,id no 27962147

I want to know my penalties.

Because of financial status, i breaked my contribution since November,2016 up to date, could it be possible for me to register afresh?

show me my facility choices and beneficiaries

hi,am in diaspora and stopped paying when I left the country in 2015,I want to reactivate my account how do I go about it online.ID22416896

am peter,i registered for nhif in 2015 and unfortunetry i went to school to further my education,i finished in dec 2017.this period i could not afford to pay bill of nhif. and got a job in march 2018 then i started paying again to date.what shall i do to enjoy medical services?

Hi, i resigned from work this month. I would like to know how much i should pay per month and if there is any notification that I should make to NHIF… also when should i start paying since my employer was the one paying for me.

Hi brenda ,all informal contrubutors or unemployed pay only ksh500.

thankyou.

how can i change my prefferd hospital

What happens when you give your card number instead of the I’d number ad your account number when paying through mpesa

It’s long due since I made my contribution is it possible I register afresh.

How can I make My NHIF active again after stopping for same years

My membership number is 3282415 but I have been away so I hv not made payment since 2012.Am i suppose to apply again or?

Hey Margaret

This is in regards to your NHIF matter at How.co.ke…

Visit the nearest branch of NHIF and ask to activate your account. Ideally you start afresh but still keep your details as they were.

Is it must for me to choose hospital

Yes. NHIF require all members to choose a preferred hospital.

How can I make My NHIF active immedietly after registration?Should I pay amount equivalent to 3Month or how do I backdate the payment.

I misplaced my nhif card so I need you to help me

if i have registered and made the payment on date 20,when am i supposed to pay again?

I Av Not Cmtributed For One Year while in the formal contribution: am i supposed to pay penalties Now That Am Reinstated?

Hello,i recently registered for the NHIF services, one month ago.but i would like to change the facility immediately. Is it possible? And if yes,after how long will i start enjoying the services at the new facility

Hi Shirleen

The next change of facility is happening in June

after selection of facility how long to wait before accessing outpatient services. thanks

Hi

Once you have changed the facility, its effected immediately

hi. i i fill the form for choosing facility how long will i wait to access outpatient services. thanks

Please can iknow the hospitals i choose.

Please can iknow the hospital i choose

Can I know the medical facilities am registered for online?

pliZ send me my nhif number ID no 23183001

Hi Hellen,

please check how to check your NHIF number here http://www.how.co.ke/information/how-to-check-your-nhif-number-in-case-you-misplace-the-card/

If for seven years you have not been paying, what happens if you were to start paying?

how if I stop paying

Hi

If i get what you are asking. If you stop paying you wont be able to enjoy the services when you visit the hospital.

I wanna know my last payment/status and am fired and now wanna be informal contributor.

I want to know my last payment

Hi Joseph,

Please use the procedure in the article.

Regards